POLICYHOLDER

The main role player who holds and exercises rights on the policy. Must be eighteen (18) years or older. A person or group in whose name an insurance policy is held.

SPOUSE

A person who is married to the policyholder by law, tribal custom or religion practised in South Africa. This relationship must be in place when the policy is applied for.

CHILD

An unmarried child by birth to the Policyholder or his/her Spouse, or a stepchild, or a legally adopted child, including a stillborn child after 26 (twenty-six) weeks of pregnancy and not as a result of any abortion of the mother’s choice. A child will be covered until the age of twenty-one (21) years. A child that is a full-time student or declared permanently disabled (upon receipt of proof acceptable to the Insurer) will be covered until the age of twenty-five (25)

EXTENDED FAMILY MEMBERS

A person for whose funeral costs the premium payer is financially responsible for in the event of death. These include parents, parents-in-law, grandparents, uncles, aunts, related cousins, sisters, brothers, nephews, niece, grandchil-dren, great-grandparents.

IMMEDIATE FAMILY

Your spouse and children.

COUSIN

Is a child of your aunt or uncle

Single and Family Plan– The plan covers you as the policyholder, your spouse, children and extended family members. The maximum entry age for the policyholder and the spouse is seventy-four (74) years. Maximum entry age for children is twenty-one (21). Children will enjoy cover up to the age of 21 years unless they are full time students then the cover will continue up to 25 years subject to proof being supplied. The maximum entry age for extended family members is 89 years.

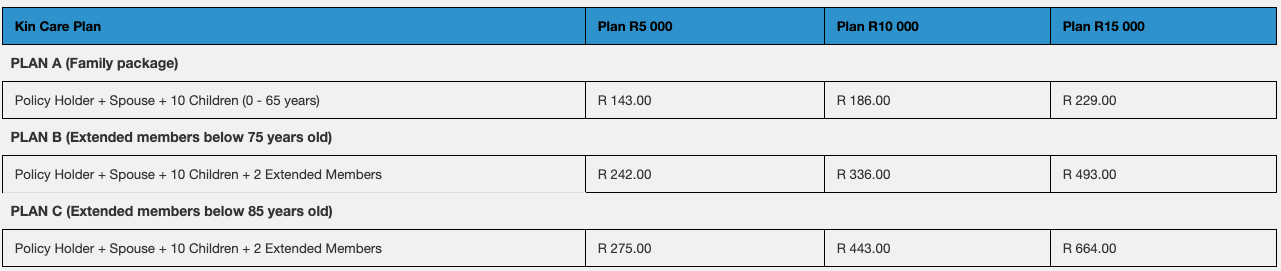

Kin Care Plan– The plan is applicable for a family, single parent, extended family and up to ten (10) own, legally adopted or foster children. The plan covers you as the policyholder, your spouse, two (2) extended members and up to ten (10) children (including own, legally adopted or foster). The maximum entry age for you and your spouse is 64 years. The maximum age entry for extended members is 84 years. Children covered on this policy remain in the policy even after twenty-one (21) years for as long as premiums are paid.

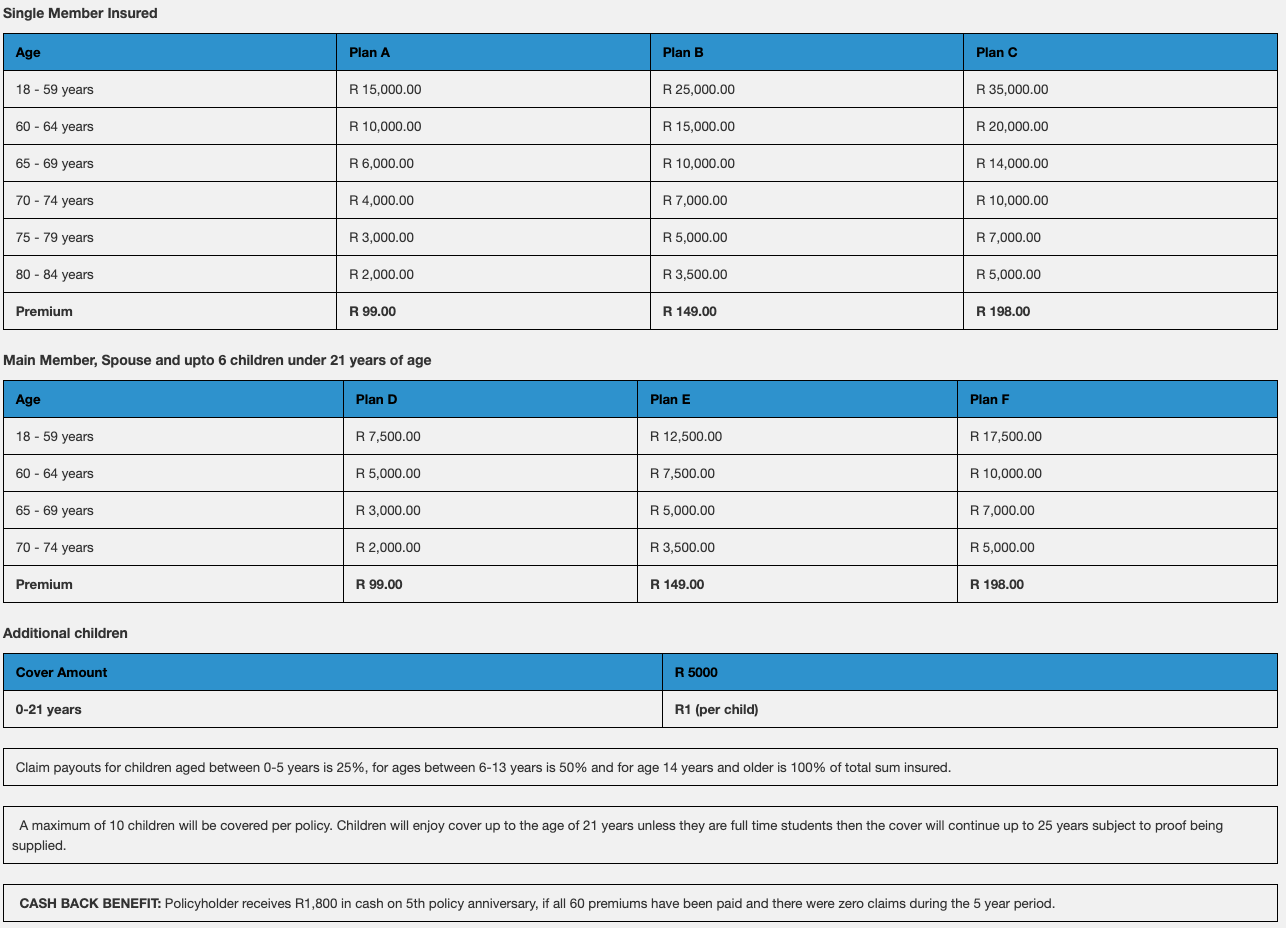

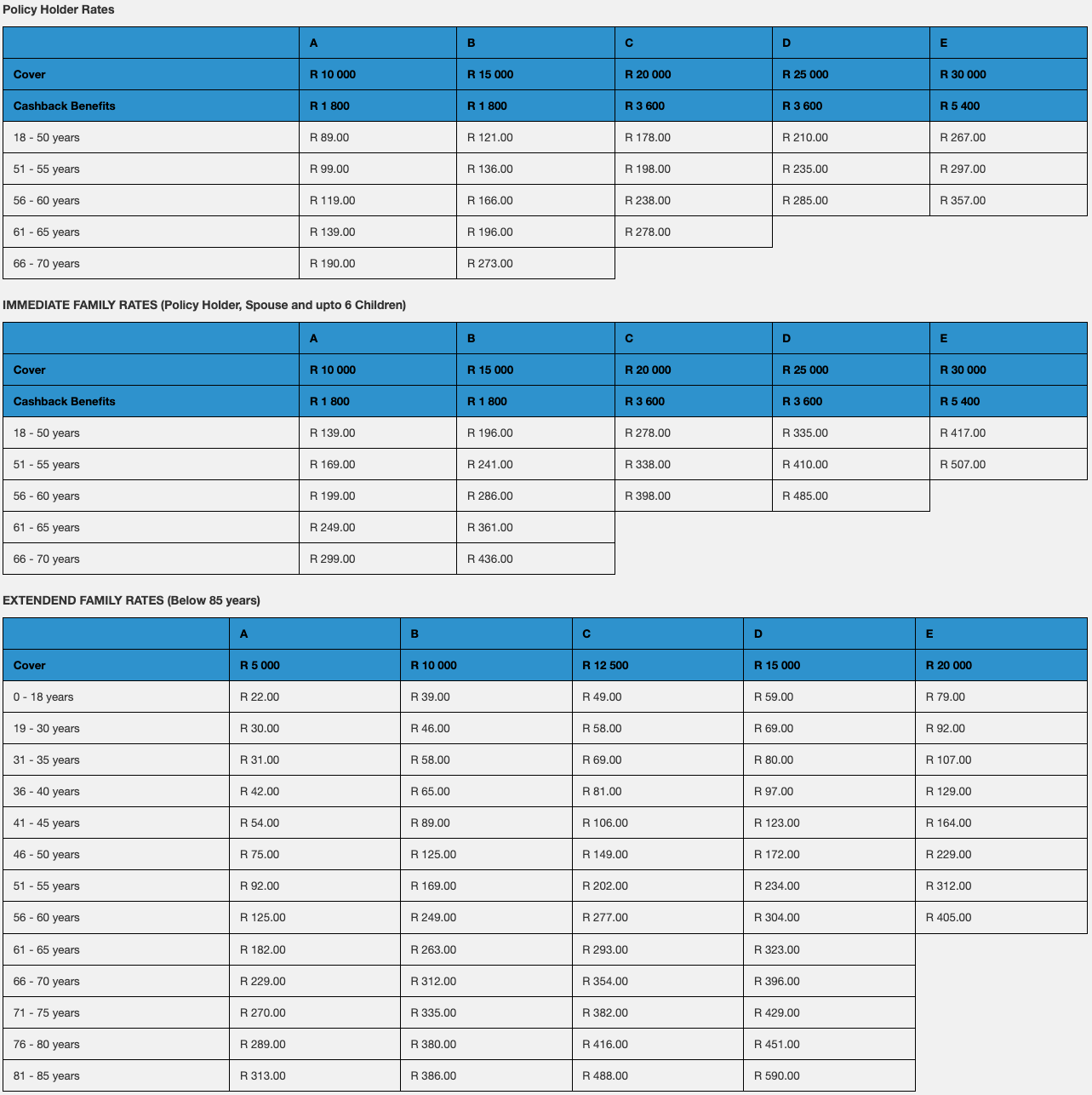

Pensioner Plan – The plan can cover you as the Policyholder, your spouse and children. A maximum of 6 children can be covered under the immediate family Plan. You may add 4 children at an extra premium. Maximum cover for additional child is R 5 000. Maximum entry age for single members is 84 years. Maximum entry age for the immediate family plan is 74 years. Children will enjoy cover up to the age of 21 years unless they are full time students then the cover will continue up to 25 years subject to proof being supplied. The Policyholder will receive a cash back benefit after sixty (60) months, on condition that all sixty (60) premiums have been paid in full and there were no claims during the 60 months period.

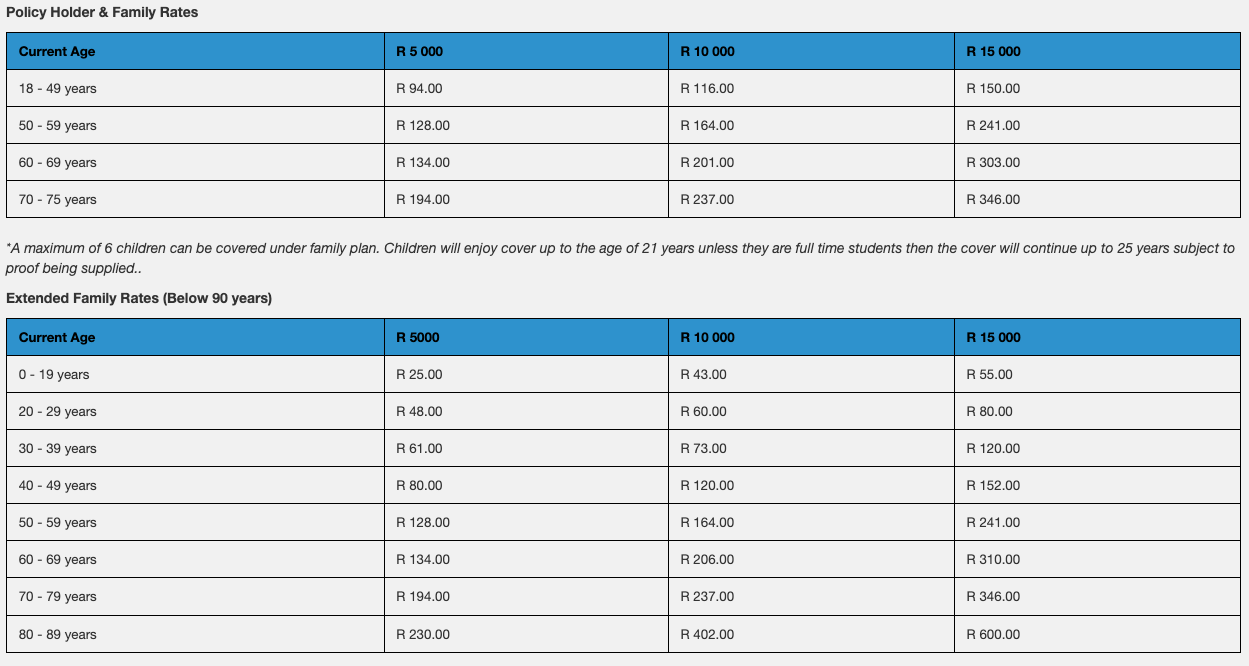

My Family Plan – The plan covers you as the policyholder, your spouse, children and extended family members. The maximum entry age for the policyholder and the spouse is sixty-nine (69) years. Maximum entry age for children is twenty-one (21). Children will enjoy cover up to the age of 21 years unless they are full time students then the cover will continue up to 25 years subject to proof being supplied. The maximum entry age for extended family members is 84 years. Policyholder will receive a cash back benefit after sixty (60) months, on condition that all sixty (60) premiums have been paid and there were no claims during the 60 month’s period.

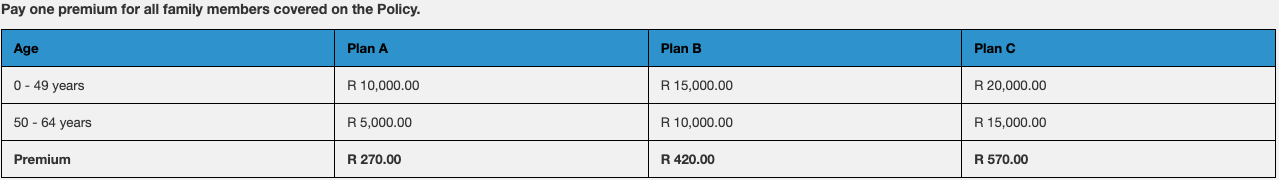

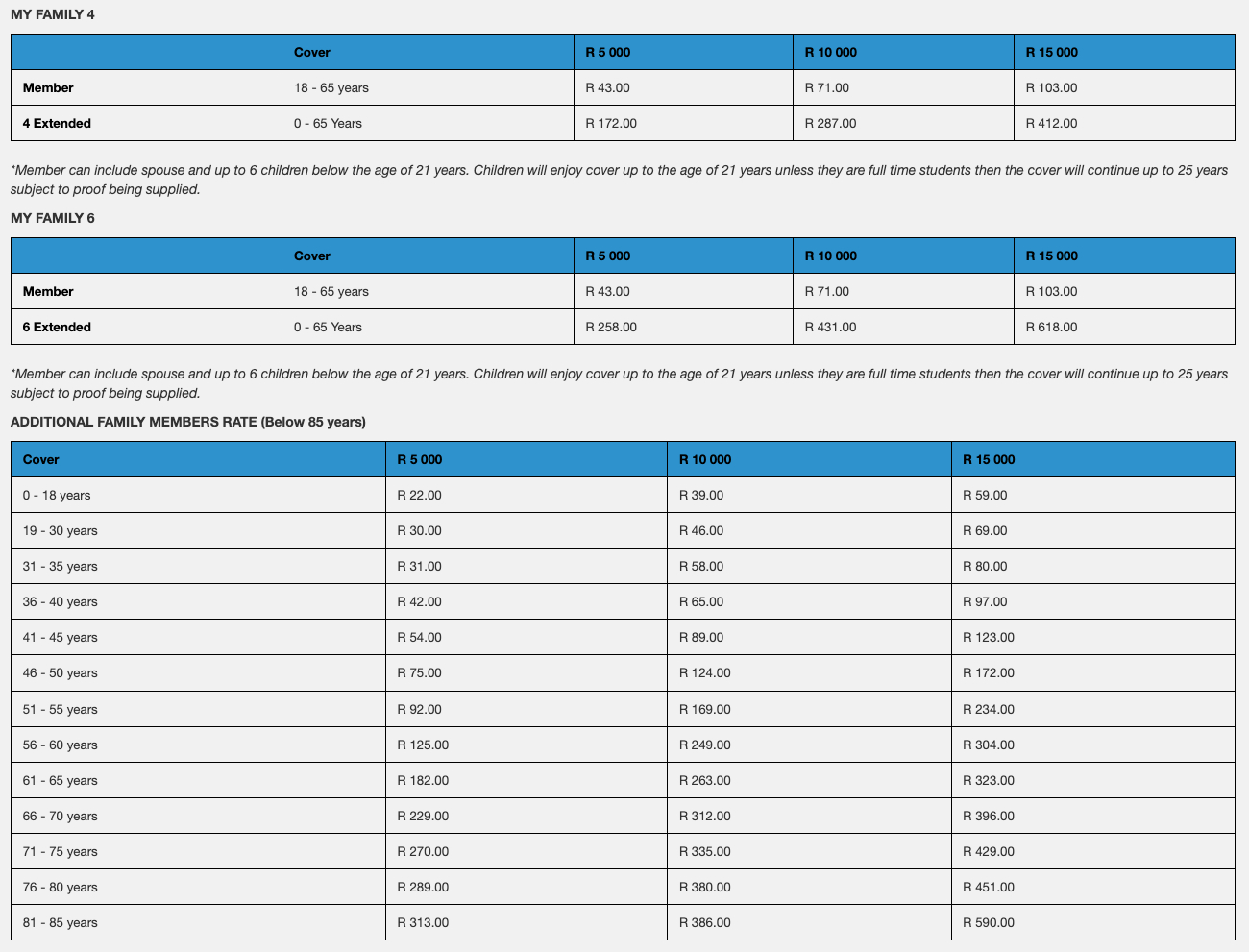

My Family 4 – This plan covers you as the policy holder, your immediate and 4 extended family members under one rate. Policy holder, spouse and extended family must be below the age of 65 years. You may add extra family members below 85 years at an additional cost. Children covered under the immediate family rates will enjoy cover up to the age of 21 years unless they are full time students then the cover will continue up to 25 years subject to proof being supplied. Policyholder must be covered in order for other dependents to be added on the policy. All members in this plan must have same cover amount, subject to the cover restrictions applicable to children.

My Family 6 – This plan covers you as the policy holder, your immediate and 6 extended family members under one rate. Policy holder, spouse and extended family must be below the age of 65 years. You may add extra family members below 85 years at an additional cost. Children covered under the immediate family rates will enjoy cover up to the age of 21 years unless they are full time students then the cover will continue up to 25 years subject to proof being supplied. Policyholder must be covered in order for other dependents to be added on the policy. All members in this plan must have same cover amount, subject to the cover restrictions applicable to children.

1 + 9 – This product provides cover for you, as the Main Member, your spouse, children, or extended family. Members who are below the age of 65 years. Policyholder must be covered for other dependents to be added on the policy. All members in this policy will be under the same plan.

Administered by Dignity Group, an authorised financial services provider FSP 44875 and underwritten by King Price Life Insurance Limited,

a licensed insurer in terms of the Insurance Act, 2017. Registration Number 1948/029011/06 (Authorised FSP: No 47235)

TERMS AND CONDITIONS

Premium payer: The person who pays premiums on the policy.

Beneficiary: A person, aged eighteen (18) or older nominated by the Policyholder as the person in respect of whom the Insurer should meet policy benefits. The Policyholder is automatically the beneficiary of the policy, in cases where Policyholder is not available to claim, the beneficiary receives the policy benefits.

Life insured: The person/ persons, covered in terms of the plan selected. Also referred to as the Policy Member(s).

Maximum cover: The maximum cover per Life insured on all Dignity Group policies is R60 000, still at all times within the ambit of the relevant Legislation and Regulation.

Insurable interest: You can take out insurance on the lives of others. You can do that only if you have an interest in the other person recognised as worthy of insurance protection, often referred to as insurable interest. You have such an interest in your spouse, children, parents, and extended family members. You do not have such interest in for example your friend or your neighbour.

Stillborn: Only two stillbirth claims will be accepted per family during the term of the policy. A new-born may be covered if the policyholder informs King Price Life in writing. within 3 months (90 days) of the birth date of the new-born child for them to be covered (on condition that the policy allows an additional member to be added).

Cover for foreign nationals: A person who has legal standing in South Africa. Cover is applicable for such members so long as they reside in South Africa and the insurable event occurs within the borders of South Africa.

Policy administration: Your policy is administered by Dignity Group, Authorised FSP, No 44875 and a Binder holder of the Insurer. The insurer is King Price Life Insurance Limited, a licensed insurer in terms of the Insurance Act, 2017. Registration Number (1948/029011/06). Dignity Group (Pty) Ltd earns a 17% commission and 9% binder fee.

Duration of your funeral assistance cover: This funeral cover policy is a whole-of-life funeral policy, which means that your cover (and your dependents’ cover) will remain in place if your policy premiums are up to date.

Policyholder responsibilities:

Your policy must be active before you or your dependents can lodge a claim. The waiting period for natural death is six (6) months. Waiting period is calculated from policy inception. Policy must have completed a period of 6 calendar months and must have 6 premiums paid in full, to qualify for a claim.

Suicidal death will be covered if the policy has completed twelve (12) months waiting period.

Accidental death: No waiting period will apply if the Policyholder or dependents were to pass away due to an accident as long as the first premium has been received and policy is active. Accidental Death means death caused directly or resulting from injuries sustained due to a sudden and unforeseen event (an accident) which occurs at an identifiable place and time and has a visible, violent and external cause and which results in the death of a Life insured.

Dignity Group will not share information with any third party unless it is for the purpose of processing data for the conclusion of your application for insurance and managing your insurance policy. Dignity Group may therefore with your permission, disclose your information to any of our legitimate business partners should it be necessary and complementary to the purpose of maintaining your policy insurance.

Administered by Dignity Group, an authorised financial services provider FSP 44875 and underwritten by King Price Life Insurance Limited,

a licensed insurer in terms of the Insurance Act, 2017. Registration Number 1948/029011/06 (Authorised FSP: No 47235)

Other important information

Description

Disclosure

1. Insurer &

Administrator

Administered by:

Dignity Group Pty Ltd. Registration Number 2017/085106/07

An Authorised Financial Service Provider. FSP Number 44875

8 Balfour Road Vincent East London.

Postnet Suite 307, Private Bag X9063.

East London 5200

Tel: 0861 777 100 Fax: 086 219 6250

Email: info@dignitygroup.co.za

www.dignitygroup.co.za

Underwritten by:

King Price Life Contact Details:

King Price Life is a licensed insurer and an authorised

Financial Services Provider. FSP Number is 47235.

Menlyn Corporate Park, Block A 175

Corobay Avenue Waterkloof Glen, Ext 11, Pretoria, 0081

Tel: +27 86 050 5050

Email: life@kingprice.co.za

Web: //www.kingprice.co.za

2. Complaints

procedure

If you have a complaint regarding the products or services, please reduce it to writing and submit it to the nearest

office or e-mail directly to the following email address within ninety (90) days:

complaints@dignitygroup.co.za. Upon receipt of a written complaint, Dignity Group will provide a written acknowledgement of receipt of the complaint within 12 hours. We will endeavour to resolve your complaint within a period of not more than six (6) weeks from receipt of a written complaint. Should there be any delays in this, we will advise you timeously.

If we are still not able to resolve the problem, you can send your complaint to King Price Life:

lifecomplaints@kingprice.co.za.

Should King Price Life not be able to resolve the problem, you can contact these independent industry bodies for help:

The Long-Term Insurance Ombud: The ombudsman’s role is to mediate between policyholders and life insurers

when they have a dispute that they can’t resolve in a way that is fair, independent and objective. The provisions of the

Long-term Insurance Act guide the ombudsman’s decisions.

Office Address: Third Floor, Sunclare Building, 21 Dreyer Street, Postal Address: Private Bag X45, Claremont, Cape

Town, 7735 | Telephone: 021 657-5000 / 012 470 9080 |Email: info@ombud.co.za

The FAIS Ombudsman: The FAIS Ombud’s role is to mediate fairly and independently between clients and financial

services providers on matters to do with financial advice. The Ombud follows the provisions of the Financial Advisory

and intermediary Services Act (FAIS Act).

Kasteel Park Office Park. Orange Building. 2nd Floor. Corner of Nossob and Jochemus Street.

Erasmuskloof. Pretoria Email: info@faisombud.co.za

3. Dignity Group

Compliance

Officer

Moonstone compliance services

25 Quantum Street, Techno Park, Stellenbosch, 7600.

Tel: 021 883 8000 Fax: 086 6050 834.

E-mail: rvermaak@moonstonecompliance.co.za

4. Policy

Replacement

How to make changes to your policy: Please contact your administration agent or Dignity Group offices should you

want the insurer to make any changes to your policy. Send a request to amendments@dignitygroup.co.za

If this Policy replaced an active funeral policy, the Waiting Period served on the replaced policy will be taken into

account. This is however only applicable in respect of the Cover amount of the replaced policy; if the selected Cover

amount is higher, then there will be a Waiting Period on the increased cover amount. This is also only applicable to

lives insured covered on the replaced policy; new Policy Members will serve the full Waiting Periods. The replacement

must be proven by the intermediary by providing a signed and completed replacement Record of Advice,

notice of cancellation with the previous insurer, and three (3) months’ payment history with the previous insurer for

each replaced policy. Should this not be received when the data is submitted, the member will default to a 6-month

waiting period.

5. Policy

Continuation

Cover will cease in respect of all Insured lives on the death of the Policyholder. Should a Family member wishes to

continue with the Policy as a new Policyholder, a new Application Form must be completed and submitted in order

for cover to continue without new or additional waiting periods being applied in respect of lives covered as at date of

death of the Policyholder. Cover in respect of all Insured lives is subject to Premiums having been received.

6. Cooling off

Period &

Conditions of

Cancellation

You can cancel your policy anytime by letting us know in writing.

If your cancellation notice reaches us within thirty-one (31) days after you received your policy summary or within

thirty-one (31) days after it reasonably can be accepted that you should have received your policy summary, your

policy ends when we receive your notice. We will pay back all premiums already paid to us provided that no claims

have been reported. This is known as cooling-off cancellation. If no such written notification is received within the

stipulated time frame, King Price Life will consider the policy as taken up and active, no refund can be effected. The

policy cover and waiting periods will be effective from the cover start date and the cover will continue as long as

future premiums are paid. Please send your signed cancellation request to cancellation@dignitygroup.co.za. You can

reverse your cancellation on an existing policy within 7 working days from receipt of cancellation.

Administered by Dignity Group, an authorised financial services provider FSP 44875 and underwritten by King Price Life Insurance Limited,

a licensed insurer in terms of the Insurance Act, 2017. Registration Number 1948/029011/06 (Authorised FSP: No 47235)

Other important information

Description

Disclosure

7. Premium

Payment

When will your cover start: Your cover will start on the 1st day of the month in which your first premium is paid. Your

premiums may be paid via debit order, stop order or easy pay. Please inform our office immediately of any changes of

your banking details or employment status change. Such information must be confirmed in writing.

Premium guarantee period: King Price Life undertakes to not change your benefits or premiums within the first

twelve (12) months, unless it is absolutely required.

Premium reviews: King Price Life reserves the right to amend, revoke, vary or alter any of the terms and conditions of

this policy provided that the Insurer gives the Policyholder at least 31 (thirty-one) days’ written notice of its intention to

do so. King Price Life reserves the right to adjust Premiums as determined by the Insurer’s Head of Actuarial Control

Function to the Policy benefits under this policy in the event of any government, provincial, municipal or other such

authority imposing any involuntary charges, levies or taxes on the Insurer in respect of this Policy.

Arrears: Should a premium not be received on the premium due date; such policy will be regarded as in-arrears. This is

when your policy misses one (1) month’s premium payment and, in case of a claim, the value of the outstanding

premium will be deducted from the claim amount.

Lapsing of policy: Your policy will lapse if:

A lapsed policy is considered cancelled and no further collection attempts will be made.

Reinstatement of policy: If the Policy benefit lapses due to non-payment of premiums, the Policyholder may apply for

reinstatement of cover. Reinstatement will be allowed within 2 months from the effective lapse date, without imposing a new waiting period. The remaining period of a waiting period that had not yet passed at the time of lapse, will

however still apply and outstanding premiums have to be paid in order for a reinstatement of cover to occur.

Reinstatement of cover is not allowed at claim stage.

Refunds: The turnaround time for a refund request will be processed within 7-14 working days. Should you fail to inform

Dignity Group within ninety (90) days to stop collecting premiums of a deceased member, the Insurer / Dignity Group reserves the right to recover collection fees before refunding your premiums.

8. Claims

Misrepresentation or non-disclosure will result in the repudiation of your claim.

How to claim: Claims must be submitted within (12) twelve months of the death event. Failure to do so within the

stipulated time frame will result in King Price Life not processing your claim. You must give Dignity Group all the

required documents before King Price Life can process your claim.

9. Claims

Documentations:

Dignity Group will provide you with a claim form that you will be required to complete.

You may visit Dignity Group office near you, or call 0861 777 100 or email claims@dignitygroup.co.za.

NOTE: Should the Policyholder and the beneficiary be deceased when the claim event occurs, the policy benefit will be

paid to an appropriately nominated or mandated person at the discretion of the Insurer.

King Price Life reserves the right to:

General exclusions: King Price Life will not pay your claim in the following circumstances:

Administered by Dignity Group, an authorised financial services provider FSP 44875 and underwritten by King Price Life Insurance Limited,

a licensed insurer in terms of the Insurance Act, 2017. Registration Number 1948/029011/06 (Authorised FSP: No 47235)

___________

About 1+9 Burial Plan

*This product provides cover for you, as the policyholder, your spouse, children or extended family members who are below the age of 65 years..

*Claim payouts for children aged between 0-5 years is 25%, for ages between 6-13 years is 50% and for age 14 years and older is 100% of total sum insured.

Benefits

Administered by Dignity Group, an authorised financial services provider FSP 44875 and underwritten by King Price Life Insurance Limited, a licensed insurer in terms of the Insurance Act, 2017. Registration Number 1948/029011/06 (Authorised FSP: No 47235).

___________

About Pensioner Plan

*A maximum of 10 children will be covered per policy. Children will enjoy cover up to the age of 21 years unless they are full time students then the cover will continue up to 25 years subject to proof being supplied.

*Claim payouts for children aged between 0-5 years is 25%, for ages between 6-13 years is 50% and for age 14 years and older is 100% of total sum insured.

Benefits

Administered by Dignity Group, an authorised financial services provider FSP 44875 and underwritten by King Price Life Insurance Limited, a licensed insurer in terms of the Insurance Act, 2017. Registration Number 1948/029011/06 (Authorised FSP: No 47235).

___________

About Kin Care Plan

*Cover for children continues after the age of 21 years.

Benefits

Administered by Dignity Group, an authorised financial services provider FSP 44875 and underwritten by King Price Life Insurance Limited, a licensed insurer in terms of the Insurance Act, 2017. Registration Number 1948/029011/06 (Authorised FSP: No 47235).

___________

About Single Family Plan

Benefits

Administered by Dignity Group, an authorised financial services provider FSP 44875 and underwritten by King Price Life Insurance Limited, a licensed insurer in terms of the Insurance Act, 2017. Registration Number 1948/029011/06 (Authorised FSP: No 47235.

Please follow below steps

Kin Care, Family & Pension Plan My Family Plan 1+9 Burial Plan

___________

About My Family 4 & 6

Administered by Dignity Group, an authorised financial services provider FSP 44875 and underwritten by King Price Life Insurance Limited, a licensed insurer in terms of the Insurance Act, 2017. Registration Number 1948/029011/06 (Authorised FSP: No 47235.

___________

About My Family

Administered by Dignity Group, an authorised financial services provider FSP 44875 and underwritten by King Price Life Insurance Limited, a licensed insurer in terms of the Insurance Act, 2017. Registration Number 1948/029011/06 (Authorised FSP: No 47235.